Professional Liability Insurance Costs

- How Much Does Professional Liability Insurance Cost? | Commercial Insurance **Professional Liability Insurance Costs

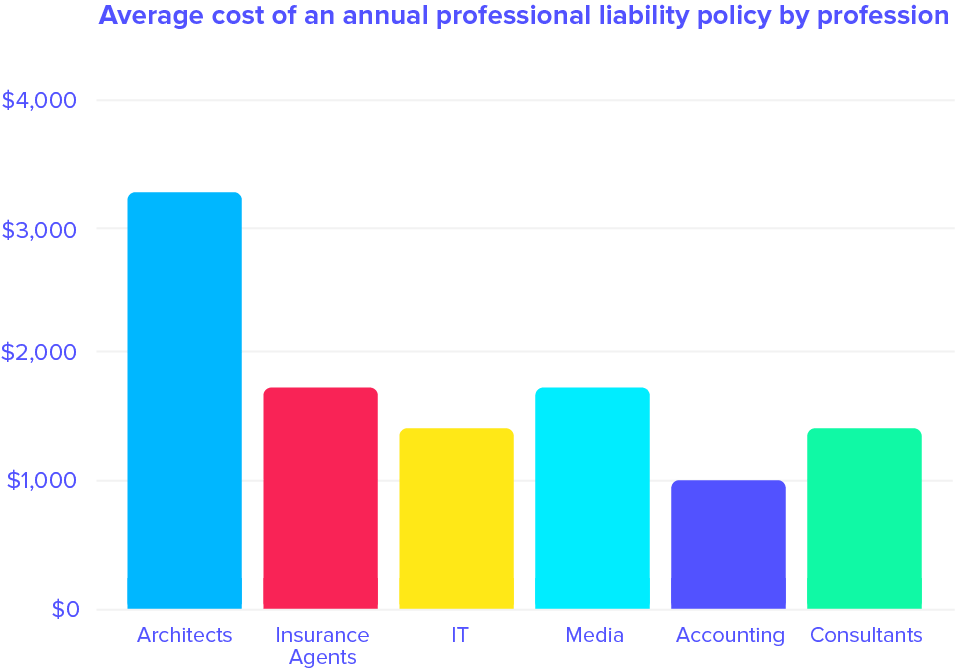

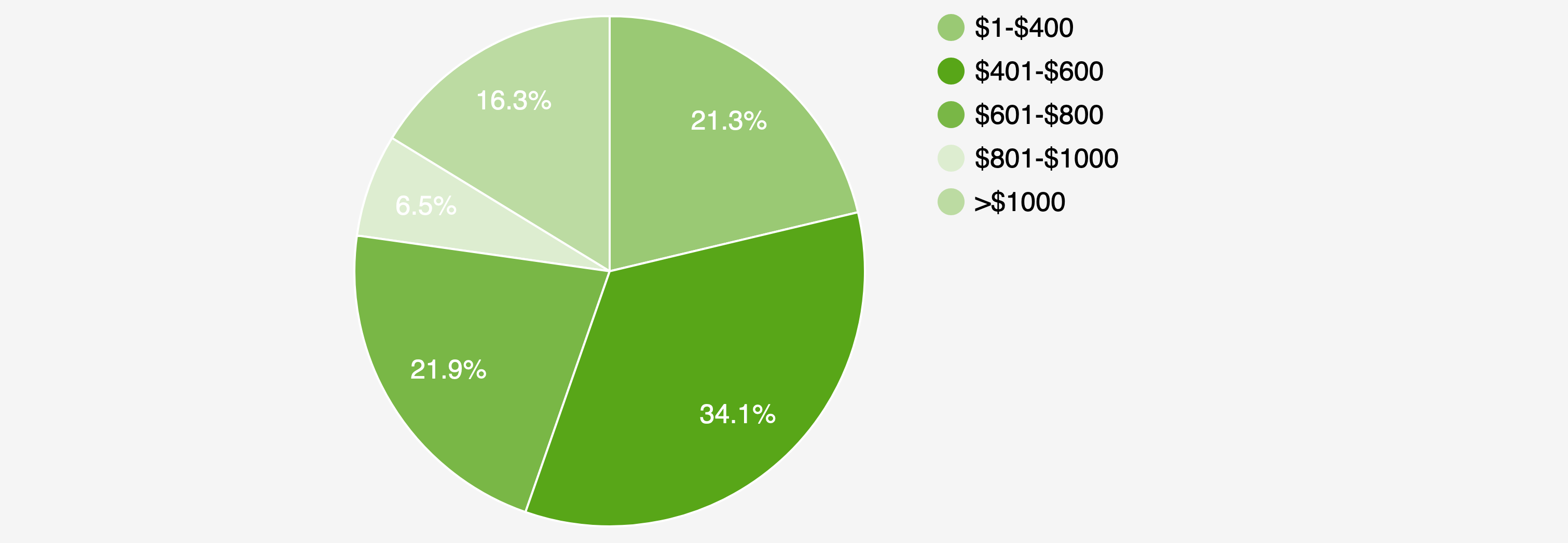

- How Much Does Professional Liability Insurance Cost? | Commercial Insurance**. We can provide public, employers' and product liability packaged together with professional indemnity insurance easily in one package. Without adequate insurance protection, your clients, your reputation, your company and even your personal assets may be at risk. In addition to covering awards for claims (up to the declared limits of the policy), a professional liability insurance policy also covers any associated legal costs. Since defending yourself in court can come with astronomical legal fees, sometimes running $100k or more, this errors and omissions insurance can be a godsend if you face a claim. Regardless of insurance policy limits, the median cost of professional liability insurance premiums for a small business is $59 per month ($713 annually).

Tell us what you need by requesting a quote below. Having your own professional liability insurance, designed to put your interests first, is the best way to incorporate personal risk management. Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate. The main difference between general liability and professional liability is in the types of risks they each cover. Professional liability covers more abstract risks, such as errors and omissions in the services your business provides.

Commercial Self-Employed Insurance Cost Guide | Pogo Insurance from pogo.co

Commercial Self-Employed Insurance Cost Guide | Pogo Insurance from pogo.co

Having your own professional liability insurance, designed to put your interests first, is the best way to incorporate personal risk management. Without adequate insurance protection, your clients, your reputation, your company and even your personal assets may be at risk. That's where proliability comes in. Since defending yourself in court can come with astronomical legal fees, sometimes running $100k or more, this errors and omissions insurance can be a godsend if you face a claim. Acquire a policy specific to your needs; We can provide public, employers' and product liability packaged together with professional indemnity insurance easily in one package. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. Management and professional liability insurance is designed to protect you and your business against the potentially devastating costs of those exposures.

General liability covers physical risks, such as bodily injuries and property damage.

The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. Management and professional liability insurance is designed to protect you and your business against the potentially devastating costs of those exposures. Regardless of insurance policy limits, the median cost of professional liability insurance premiums for a small business is $59 per month ($713 annually). If you require further business insurances like commercial property insurance, loss of earning, personal accident, stock cover we can provide these too. General liability covers physical risks, such as bodily injuries and property damage. Having your own professional liability insurance, designed to put your interests first, is the best way to incorporate personal risk management. In addition to covering awards for claims (up to the declared limits of the policy), a professional liability insurance policy also covers any associated legal costs. Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. That's where proliability comes in. Professional liability covers more abstract risks, such as errors and omissions in the services your business provides. Tell us what you need by requesting a quote below. Dedicated to serving the medical professional professional liability insurance for physicians.

Acquire a policy specific to your needs; We can provide public, employers' and product liability packaged together with professional indemnity insurance easily in one package. In addition to covering awards for claims (up to the declared limits of the policy), a professional liability insurance policy also covers any associated legal costs. That's where proliability comes in. We offer coverage that gives you peace of mind to focus on your patients with premiums* as low as $101 for an employed rn.

Professional liability insurance texas from cdn.slidesharecdn.com

Professional liability insurance texas from cdn.slidesharecdn.com

The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. You can count on chubb’s professional liability team for many reasons, including 20+ years in the e&o space, expertise in crafting a custom solution based on industry class and specialized coverage forms. In addition to covering awards for claims (up to the declared limits of the policy), a professional liability insurance policy also covers any associated legal costs. If you require further business insurances like commercial property insurance, loss of earning, personal accident, stock cover we can provide these too. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. Without adequate insurance protection, your clients, your reputation, your company and even your personal assets may be at risk. We offer coverage that gives you peace of mind to focus on your patients with premiums* as low as $101 for an employed rn. Dedicated to serving the medical professional professional liability insurance for physicians.

In addition to covering awards for claims (up to the declared limits of the policy), a professional liability insurance policy also covers any associated legal costs.

If you require further business insurances like commercial property insurance, loss of earning, personal accident, stock cover we can provide these too. Having your own professional liability insurance, designed to put your interests first, is the best way to incorporate personal risk management. Tell us what you need by requesting a quote below. We can provide public, employers' and product liability packaged together with professional indemnity insurance easily in one package. We offer coverage that gives you peace of mind to focus on your patients with premiums* as low as $101 for an employed rn. Acquire a policy specific to your needs; Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. The main difference between general liability and professional liability is in the types of risks they each cover. Management and professional liability insurance is designed to protect you and your business against the potentially devastating costs of those exposures. That's where proliability comes in. Since defending yourself in court can come with astronomical legal fees, sometimes running $100k or more, this errors and omissions insurance can be a godsend if you face a claim. Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate. You can count on chubb’s professional liability team for many reasons, including 20+ years in the e&o space, expertise in crafting a custom solution based on industry class and specialized coverage forms.

Professional liability covers more abstract risks, such as errors and omissions in the services your business provides. Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate. If you require further business insurances like commercial property insurance, loss of earning, personal accident, stock cover we can provide these too. Regardless of insurance policy limits, the median cost of professional liability insurance premiums for a small business is $59 per month ($713 annually). You can count on chubb’s professional liability team for many reasons, including 20+ years in the e&o space, expertise in crafting a custom solution based on industry class and specialized coverage forms.

How much does Professional Liability Insurance cost? - Bizinsure from www.bizinsure.com

How much does Professional Liability Insurance cost? - Bizinsure from www.bizinsure.com

The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. The main difference between general liability and professional liability is in the types of risks they each cover. That's where proliability comes in. Tell us what you need by requesting a quote below. Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate. We offer coverage that gives you peace of mind to focus on your patients with premiums* as low as $101 for an employed rn. Acquire a policy specific to your needs; Since defending yourself in court can come with astronomical legal fees, sometimes running $100k or more, this errors and omissions insurance can be a godsend if you face a claim.

We offer coverage that gives you peace of mind to focus on your patients with premiums* as low as $101 for an employed rn.

Since defending yourself in court can come with astronomical legal fees, sometimes running $100k or more, this errors and omissions insurance can be a godsend if you face a claim. We offer coverage that gives you peace of mind to focus on your patients with premiums* as low as $101 for an employed rn. Acquire a policy specific to your needs; Professional liability covers more abstract risks, such as errors and omissions in the services your business provides. We can provide public, employers' and product liability packaged together with professional indemnity insurance easily in one package. General liability covers physical risks, such as bodily injuries and property damage. Having your own professional liability insurance, designed to put your interests first, is the best way to incorporate personal risk management. That's where proliability comes in. Dedicated to serving the medical professional professional liability insurance for physicians. If you require further business insurances like commercial property insurance, loss of earning, personal accident, stock cover we can provide these too. The main difference between general liability and professional liability is in the types of risks they each cover. In addition to covering awards for claims (up to the declared limits of the policy), a professional liability insurance policy also covers any associated legal costs. Without adequate insurance protection, your clients, your reputation, your company and even your personal assets may be at risk.

Source: www.beatyourpb.com

Tell us what you need by requesting a quote below. That's where proliability comes in. Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate. Regardless of insurance policy limits, the median cost of professional liability insurance premiums for a small business is $59 per month ($713 annually). Professional liability covers more abstract risks, such as errors and omissions in the services your business provides.

Source: greatoutdoorsabq.com

We can provide public, employers' and product liability packaged together with professional indemnity insurance easily in one package. Acquire a policy specific to your needs; Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence. Management and professional liability insurance is designed to protect you and your business against the potentially devastating costs of those exposures. Having your own professional liability insurance, designed to put your interests first, is the best way to incorporate personal risk management.

Source: www.insureon.com

That's where proliability comes in. General liability covers physical risks, such as bodily injuries and property damage. Having your own professional liability insurance, designed to put your interests first, is the best way to incorporate personal risk management. Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate. Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence.

Source: www.hiscox.com

Acquire a policy specific to your needs; The main difference between general liability and professional liability is in the types of risks they each cover. Professional liability covers more abstract risks, such as errors and omissions in the services your business provides. If you require further business insurances like commercial property insurance, loss of earning, personal accident, stock cover we can provide these too. General liability covers physical risks, such as bodily injuries and property damage.

Source: costfreak.com

Regardless of insurance policy limits, the median cost of professional liability insurance premiums for a small business is $59 per month ($713 annually). Without adequate insurance protection, your clients, your reputation, your company and even your personal assets may be at risk. That's where proliability comes in. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums. General liability covers physical risks, such as bodily injuries and property damage.

Source: 3.bp.blogspot.com

The main difference between general liability and professional liability is in the types of risks they each cover. General liability covers physical risks, such as bodily injuries and property damage. Since defending yourself in court can come with astronomical legal fees, sometimes running $100k or more, this errors and omissions insurance can be a godsend if you face a claim. Regardless of insurance policy limits, the median cost of professional liability insurance premiums for a small business is $59 per month ($713 annually). Management and professional liability insurance is designed to protect you and your business against the potentially devastating costs of those exposures.

Source: ecosfera.cat

You can count on chubb’s professional liability team for many reasons, including 20+ years in the e&o space, expertise in crafting a custom solution based on industry class and specialized coverage forms. In addition to covering awards for claims (up to the declared limits of the policy), a professional liability insurance policy also covers any associated legal costs. Having your own professional liability insurance, designed to put your interests first, is the best way to incorporate personal risk management. General liability covers physical risks, such as bodily injuries and property damage. That's where proliability comes in.

Source: www.insureon.com

The main difference between general liability and professional liability is in the types of risks they each cover. In addition to covering awards for claims (up to the declared limits of the policy), a professional liability insurance policy also covers any associated legal costs. That's where proliability comes in. Professional liability covers more abstract risks, such as errors and omissions in the services your business provides. Dedicated to serving the medical professional professional liability insurance for physicians.

Source: www.paragonunderwriters.com

Professional liability covers more abstract risks, such as errors and omissions in the services your business provides. Since defending yourself in court can come with astronomical legal fees, sometimes running $100k or more, this errors and omissions insurance can be a godsend if you face a claim. Acquire a policy specific to your needs; Dedicated to serving the medical professional professional liability insurance for physicians. That's where proliability comes in.

Source: images.sampleforms.com

That's where proliability comes in.

Source: 1.bp.blogspot.com

Dedicated to serving the medical professional professional liability insurance for physicians.

Source: 3dvteh5malm1sr0241dpaps1-wpengine.netdna-ssl.com

Management and professional liability insurance is designed to protect you and your business against the potentially devastating costs of those exposures.

Source: amapubs-activation.org

Tell us what you need by requesting a quote below.

Source: images.sampleforms.com

Acquire a policy specific to your needs;

Source: res.cloudinary.com

We can provide public, employers' and product liability packaged together with professional indemnity insurance easily in one package.

Source: res.cloudinary.com

The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

Source: lawrenceks.org

If you require further business insurances like commercial property insurance, loss of earning, personal accident, stock cover we can provide these too.

Source: www.insureon.com

Tell us what you need by requesting a quote below.

Source: www.smartbusinessinsurance.com.au

Management and professional liability insurance is designed to protect you and your business against the potentially devastating costs of those exposures.

Source: i.pinimg.com

Dedicated to serving the medical professional professional liability insurance for physicians.

Source: assets-us-01.kc-usercontent.com

Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate.

Source: cdn.slidesharecdn.com

Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate.

Source: fitsmallbusiness.com

Without adequate insurance protection, your clients, your reputation, your company and even your personal assets may be at risk.

Source: i.pinimg.com

General liability covers physical risks, such as bodily injuries and property damage.

Source: www.bizinsure.com

Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate.

Source: www.siprisk.com

Dedicated to serving the medical professional professional liability insurance for physicians.

Source: www.bizcover.com.au

Chubb’s professional liability solutions are designed to provide the insurance protection needed in today’s business climate.

Source: www.bizcover.co.nz

Professional liability covers more abstract risks, such as errors and omissions in the services your business provides.

Source: www.akca.org

You can count on chubb’s professional liability team for many reasons, including 20+ years in the e&o space, expertise in crafting a custom solution based on industry class and specialized coverage forms.

Source: www.acadiainsurance.com

General liability covers physical risks, such as bodily injuries and property damage.

Source: info.protexurelawyers.com

The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

Source: greatoutdoorsabq.com

The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

Source: asa2.silverchair-cdn.com

Liability insurance is any insurance policy that protects an individual or business from the risk that they may be sued and held legally liable for something such as malpractice, injury or negligence.

Source: ecosfera.cat

Professional liability covers more abstract risks, such as errors and omissions in the services your business provides.